VBC Enablement: Paving The Way for Value

Examining the continued rise of VBC enablement and its ability to help transition providers to value.

Every month we write a piece encompassing themes within our whole-person health thesis. If you would like to receive it directly in your inbox, subscribe now.

VBC enablement headlines have been hitting the tape at an intensifying pace, being heralded by some desks as the most important mechanism in driving VBC adoption over the next decade.

While public VBC enablement names are well covered across the street, we’ve seen a ton of exciting innovation in private markets that’s worth examining given the formative role these platforms will play in the transition to value and the outsized capital deployment we’ve seen in the space over the past 18 months.

Background

Medicare and Medicaid represent the two highest per person spend populations in the US, collectively making up 41% of total health consumption expenditures annually across 130M lives. And absent any payment reform to the current fee-for-service (FFS) environment, the outsized expenditures across both groups will only be exacerbated by population-specific trends in the years to come.

Within Medicare, older adults use three times the healthcare services of commercial patients, and their population is expected to rapidly expand over the next decade. By 2030, 1 in 5 Americans will be covered by Medicare or Medicare Advantage (MA) - up significantly from 1 in 10 Americans when Medicare was first introduced in 1965.1 This puts pressure not only on payers, but also on providers who face material margin compression as their panel shifts away from more lucrative commercial rates.

Within Medicaid, the historical lack of access and health equity have resulted in suboptimal utilization behavior, alarmingly poor health outcomes and hemorrhaging costs as the population reaches all-time highs.

In an effort to combat these negative trends, CMS has established a goal to have 100% of Medicare beneficiaries and the vast majority of Medicaid beneficiaries in accountable care relationships (i.e., VBC) by 2030. Underlying this effort are risk-based programs purpose-built for high needs populations. Examples include:

As shown above, the majority of these programs are designed for the Medicare population, which has the highest adoption of alternative payment models (APM) as a result. In contrast, Medicaid and commercial have lower APM uptake given the relative lack of built-in risk adjustment opportunities and the lack of established risk-based programs across the two populations.

That said, encouraging progress has been made with the recent establishment of programs such as Enhanced Care Management (ECM) and Making Care Primary (MCP) as well as with the growing success of commercial accountable care organizations (ACOs).

From a care delivery point of view, the value-add of these risk-based programs is well understood at this point. Combining longitudinal care with a payment structure that better aligns providers with outcomes is a big step forward. Care models within these programs often include the use of interdisciplinary care teams focused on whole-person health, and have had early success in improving clinical outcomes and lowering costs.

And while the administrative value-add of these risk-based programs may be less clear on the surface, it’s equally as impactful. One of the main administrative advantages of a defined care program is the establishment of scalable contracting and payment rails that can expedite the shift to VBC and allow providers to get closer to the premium dollar (i.e., increase medical margins).

Without these programs in place, providers have to contract with managed care plans (MCPs) on a bespoke basis. This motion typically leads to longer contracting cycles and greater contract/ services variability, precluding many unsophisticated providers from ever taking on risk in the first place.

And yet, even with these contracting and payment rails in place to aid the clinical and administrative shift toward value, providers ranging from independent clinics to larger medical groups still struggle to shift their legacy FFS business into VBC contracts.

Some of the transition friction can be attributed to the lack of actuarial intelligence to forecast and conduct risk-adjustment with MCPs. Other common sources of friction include the lack of infrastructure and network adequacy needed to succeed in a variety of risk-bearing arrangements. These pain points have created a chasm in which we have a number of new, innovative risk-based programs purpose-built for high needs populations, yet the majority of providers don’t have the resources and capabilities to participate in them.

This gap spawned the VBC enablement opportunity that has been en vogue recently across both public and private markets. VBC enablers bridge the gap via a comprehensive platform that equips partnering providers with high value networks and wraparound services, greatly enhancing their care delivery capabilities and enabling them to participate in risk-based programs or arrangements.

While VBC enablement first made its mark with Medicare-focused companies such as Agilon (AGL) and Privia (PRVA) that provide enablement services to primary care providers, emerging companies are expanding the scope of target payer type, target specialty type and wraparound infrastructure & capabilities - all ultimately aimed at shepherding more providers into risk.

VBC Enablement Overview

Any successful value-based care transformation roadmap addresses three core structural components: (1) a high-performing, value-oriented network, (2) risk-bearing partners that want to contract for value/ risk with that network at scale, and (3) infrastructure and capabilities to enable the network and contract performance.2

As alluded to in the preceding section, the majority of existing providers lack at least one of the three core structural components, making the shift to VBC a non-starter on their own. However, by partnering with a VBC enablement company, existing providers can fill these gaps through a variety of products and services offered by VBC enablers, including:

🌐 A high value network

A VBC enabler’s high market share of partnering providers and deep community integration in a particular region provide scale to influence healthcare utilization and delivery, offering partners the following network services:

Specialist vetting toward highest value providers

ED diversion

Community supports navigation

Unification under a single medical group also affords partnering providers with shared best practices and shared decision making among clinicians

📝 Access to VBC contracts

VBC enablers remove the friction of contracting and forecasting for partnering providers

VBC enablers provide an established medical group that aggregates partnering providers under a single-tax ID entity where risk-bearing contracts are organized with MCPs or organized as accountable care organizations (ACOs)

It’s important to note that while partnering providers will be under the enabler’s medical group for contracting purposes, they still maintain autonomy within their practices

Partnering providers can take advantage of a VBC enabler’s corporate relationship with CMS or MCPs, giving them a seat at the table in discussions about strategies in the transition to VBC

⚙️ Infrastructure and capabilities

In addition to contracting, VBC enablers provide partnering providers with other wraparound services typical of a managed service organization (MSO) that are needed to sustain performance in risk-based arrangements, including:

Administrative/ operational wraparound:

Comprehensive technology stack that enables:

Risk stratification / Predictive analytics

Population health

Performance analytics & reporting

Revenue cycle management

Coding / Risk adjustment

Digital engagement

Care management wraparound

Clinical care management via NPs, RNs and LCSWs

Social care management via CHWs

Care coordination

Rx reconciliation education and support

Wellness coaching (e.g., dietician)

The GS Healthcare desk’s initiating coverage of Privia (PRVA) does a great job of distilling out these three core structural components and speaking to how it unlocks scale.

Business Model Advantages

As the market continues to reward austerity over growth, the VBC enablement business model offers unique advantages that position companies in the space for success. Specifically, we find the scalability of the capital-light partnership motion and the financial alignment with partnering providers to be compelling and a driver of durable growth.

Capital-light partnerships

Capital efficiency and superior scalability highlight the advantages of the partnership model that VBC enablers utilize.

Traditional ownership-based practices own their facilities, employ their providers, build new practices and add patients over time - an approach that requires a ton of upfront investment and leads to an elongated J-curve before a facility is considered financially mature. It’s this very aspect that led Oak Street (OSH) to cut forecasts last year around its center opening cadence. As covered extensively by Health Tech Nerds, analysts were up in arms over the valuation OSH received in its recent acquisition by CVS Health, citing skepticism around its cohort maturation timeline. In other words, OSH’s de novo build cadence is outpacing how long it takes for those centers to become profitable.

Rather than building de novo, VBC enablers drive growth by partnering with established practices and aggregating their lives under care - forgoing any intensive upfront capex requirements in the process. This approach can unlock rapid growth velocity that is relatively unconstrained by capital, resulting in significantly shorter J-curves. However, VBC enablers still must ensure that growth does not outpace cohort maturation regardless of how well capitalized they are.

Tapping the GS Healthcare desk one more time, they provide an awesome comparative analysis of the two models, examining the capital efficiency between various ownership-based providers and VBC enabler, Agilon (AGL):

In an environment in which the cost of capital is rising and accessibility to capital has become more constrained in early-stage healthcare, the capital-light partnership motion is an attractive attribute for VBC enablement companies across the entire maturity spectrum.

Physician alignment

VBC enablers seek to lower medical costs and improve patient care by aligning financial incentives with physician partners and building high market share at the local level, thus having the scale to influence healthcare utilization and delivery within the market.

As described in the Overview section, VBC enablers partner with existing providers and form risk-bearing contracts with payers. These risk-bearing contracts can be organized with MCPs sponsoring MA plans or organized as accountable care organizations (ACOs) whereby the VBC enabler and its partnering providers can participate in programs like Medicare Shared Savings Program (MSSP). Keeping this in mind, let’s look at a few illustrative examples of how financial alignment is constructed:

Shared Savings arrangement (e.g., MSSP)

VBC enablers form accountable care organizations (ACOs) to care for an assigned population of Medicare fee-for-service (FFS) beneficiaries. Partnering providers join these ACOs. The ACO’s goal is to drive savings versus a baseline and benchmark for total cost of the assigned population. The difference between the benchmark and the actual cost of care represents the generated savings received by an ACO, which is split ~60/40 between partnering provider and VBC enabler.

Full-risk arrangement (e.g., MA)

An MCP agrees to pay the VBC enabler a fixed capitation rate per member per month (PMPM) and the VBC enabler agrees to pay for all of the health needs of the patient, which are rendered by the partnering providers. The difference between the PMPM and the cost of care represents the medical margin, which is evenly split between the VBC enabler and partnering provider.

Financial alignment between the two parties is the key element. Because generated medical margin or savings is split by the two parties, the VBC enabler does everything it can to augment the partnering providers’ ability to succeed in risk-based arrangements via wraparound products/ services, while the provider partner is incentivized to embrace cost saving utilization influences at the local level (e.g., optimizing specialist referral patterns, community support referrals). Moreover, the VBC enabler’s incentive is deepened by the fact that they typically take responsibility for any downside risk in the value-based contracts. In other words, VBC enablers only succeed when provider partners generate medical margin or cost savings.

It’s important to note that because VBC enablers derive revenue from a split share of generated medical margin or savings per patient, achieving profitability requires rapidly growing the number of attributed lives - especially for platforms enabling shared savings arrangements.3 For reference, net savings (after share portion) in MSSP ACOs have historically been ~$15 PMPM. As VBC enablers expand their enablement capabilities to capture a greater share of a partnering provider’s panel, prioritizing VBC arrangements with higher revenue and margin capture potential (e.g., MA) is vital to long-term growth. For comparison sake, Agilon has guided to net medical margin (after share portion) in full-risk MA arrangements of $75-100 PMPM for mature markets.

Expanding Landscape & Scope

The first vintage of VBC enablers helped partnering primary care providers shift their Medicare panel into risk-based arrangements via network and tech-focused MSO wraparounds. On the back of their success, a new wave of enablement companies is emerging.

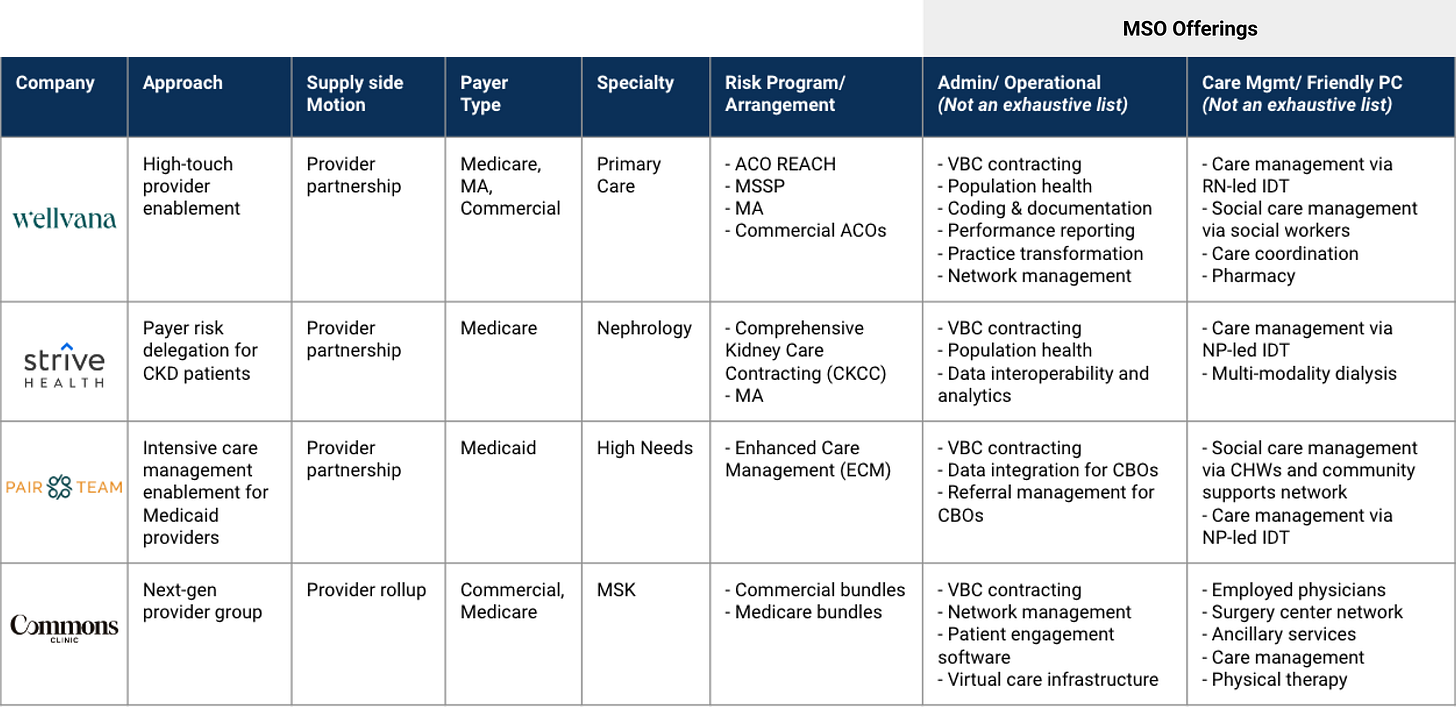

Some are pursuing VBC enablement within Medicaid, commercial or carved out specialty care (e.g., cardiology, oncology). Others are offering deeper MSO offerings such as care management or clinical functions through the attached medical group (Friendly PC). A handful are doing both. And one is operating as a next-gen provider group (i.e., employs physicians) that flips surgeon case volume into bundled contracts. Let’s take a detailed look at some of these platforms driving VBC expansion in unique ways.

Zooming out, below is a non-exhaustive list of companies in the broader VBC and VBC enablement ecosystem.

Final Thoughts

As CMS pursues its goal of having all of its beneficiaries in accountable care relationships by 2030, VBC enablement will certainly play a crucial role in driving the transition to value over the next decade as target payer and specialty scope expands.

The expansion in scope also sets the stage for potential consolidation in the years to come as larger VBC enablers look to expand their share of a partnering provider’s panel.

However, one final aspect to consider when analyzing the VBC enablement model is - how similar is it to the physician practice management (PPM) models of the past and how can we prevent any of the negative outcomes associated with those PPMs from happening again? Hospitalogy did a great job of calling out the parallels between the VBC enablement model and the PPM model recently and how PPM learnings from the past could play into both the bull case and the bear case for VBC Enablement.

Without getting too into the weeds, most analysts agree on the fact that historical failures with the PPM model resulted from:

Financial misalignment between PPMs and provider affiliates. Rather than achieving the operating efficiencies through integration and automation, PPMs added extra administrative costs and management fees, often making practices more bureaucratic and less profitable.4 Moreover, upfront cash provided to senior provider partners at acquisition added leverage, which was further dilutive to profitability, and created additional misalignment with junior providers whose compensation stayed flat.

Capital intensive M&A. PPM growth was driven by accelerated pace of acquisitions with limited value creation given the point above. This approach required a meaningful amount of leverage and left little liquidity to use for practice transformation and integration efficiency, leading to unhappy provider affiliates, waning margins and contract defections.

In this new iteration, we feel strongly that the enablement model’s capital-light GTM motion and financial alignment with partnering providers positions it for durable growth and addresses the negative aspects of the PPM model that preceded it.

The progress made within value-based contracting and the incremental margin capture opportunity it presents is the key mechanism that creates financial alignment with providers (via split profits with downside risk protection) and allows the capital-light partnership motion to work from a unit economics perspective. By forgoing capital-intensive practice acquisitions, new capital can be invested back into building a platform that can drive integration efficiency and ensure clinical and cultural satisfaction.

If you are building or investing within our whole person health thesis, we’d love to chat! Please reach out to jordan@nextventures.com or head over to our website.

https://pitchbook.com/webinars/fueling-success-in-the-medicare-advantage-market-a-fireside-chat-with-optum-advisory-services

https://pitchbook.com/webinars/fueling-success-in-the-medicare-advantage-market-a-fireside-chat-with-optum-advisory-services

https://pitchbook.com/news/reports/q2-2023-pitchbook-analyst-note-value-based-care-an-investors-guide

https://www.fiercehealthcare.com/practices/industry-voices-private-equity-may-be-repeating-mistakes-physician-practice-management