A New Year of Whole-person Health

Reflecting on the market and our thesis, while anticipating thematic developments in the year to come.

Every month we write a piece encompassing themes within our whole-person health thesis. If you would like to receive it directly in your inbox, subscribe now.

As we close the books on the past year, we wanted to take some time to reflect on the market and our thesis, while anticipating thematic developments in the year to come.

2022 was defined by the significant correction in public and private markets as we completed the transition away from an era of excess and into an era of austerity.

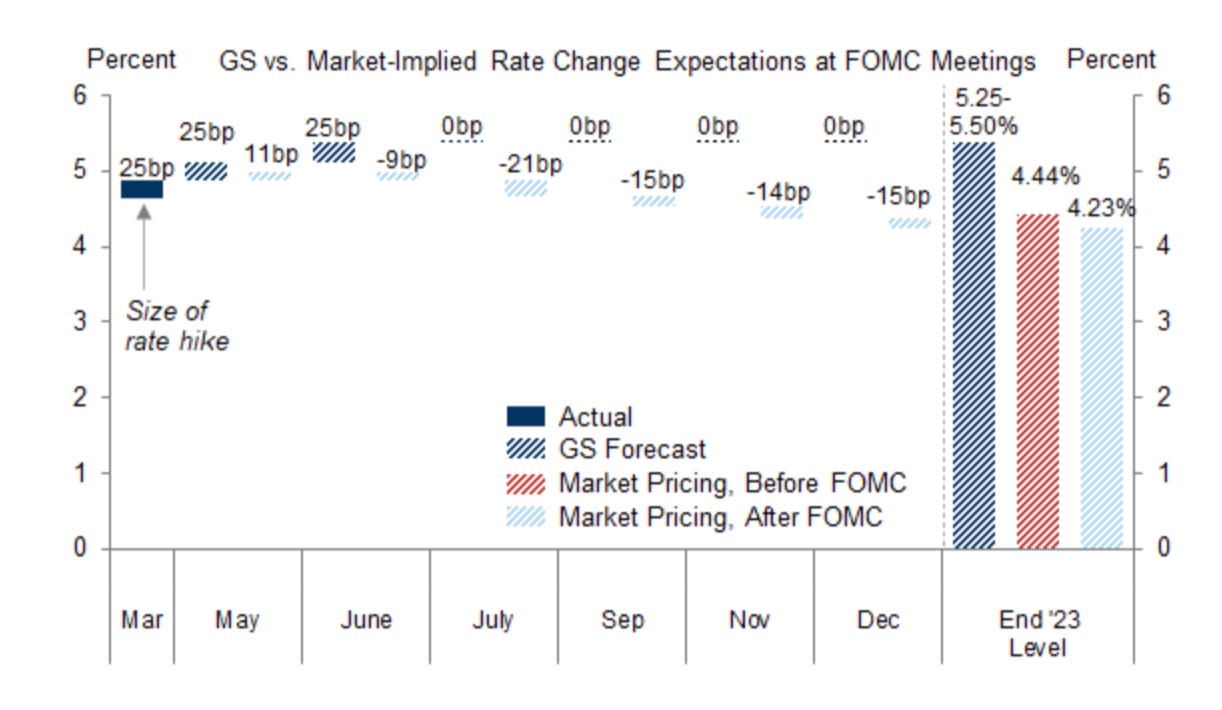

Whipsawing inflation data remains the prominent macro driver of the US economy. Despite what looked like a disinflationary period to start 2023, renewed reacceleration risk fueled by rising real income and better global growth is reinvigorating hawkish policy and the notion of rates staying higher for longer - even despite the recent US banking turmoil and reduced credit availability that will function as an additional lever to temper growth.

As a result, we should continue to see downward pressure on exit liquidity and late-stage financings as well as the exodus of nontraditional participation.

And yet, Seed prices remain robust given their insulation from macro headwinds and the proliferation of micro funds in recent years. YTD pre-money valuations for Seed financings within our thesis and across all sectors have ticked up compared to 2022.1 However, given the data only includes completed deals, a caveat lies in survivorship bias. Anecdotally, we’ve seen investors remain increasingly discriminatory around traction and efficiency, leading to significantly lower deal count YoY and a decrease in graduation rate from Seed to Series A.

On the micro side of things, there have been recent, material developments occurring at the bookends of the health market, serving as an indication of what’s to come thematically.

At the top of the market, vertical integration has been a key theme over the past year as retail giants (e.g., CVS, Amazon) and leading payers (e.g., UHC) look to best position themselves to get closer to the premium dollar and tap into uncapped services profits, respectively.

Further downmarket, startups across all facets of our thesis are facing the fallout from raising at inflated valuations in 2021/early 2022, resulting in an uptick in not only M&A, but also dissolutions. There were a disproportionate amount of bolt-on acquisitions (as opposed to platform investments) in 2022 as PE firms with record dry powder saw the normalized valuation landscape as an opportunity to add great technology assets to their portfolios.2

So what does this mean for us in the year ahead?

As it relates to upmarket precedence, we’re keeping an eye on the new wave of companies that are looking to enable providers to enter into risk-based arrangements via vertical integration/ optimization of administrative or care delivery operations. These companies come in all shapes and sizes, ranging from MSO and clinical wraparounds to data interoperability plays.

As it relates to the decrease in graduation rates in early-stage, we expect M&A volume to remain strong over the next twelve months as the current fundraising market presents diverging paths for operators and their boards: (1) try to raise capital in an increasingly competitive and scrutinous environment or (2) find a buyer at a price that clears the preference stack.3

We expect to see continued consolidation across siloed digital health services, digital health infrastructure and fitness & wellness infrastructure startups that raised their last round at the top of the market, serving as a stark reminder to stay diligent around the underwriting risk inherent to companies with difficult upmarket motions or serving narrow populations.

A quick note on our thesis - whole-person health continues to be a leading theme that we’ve observed other funds, consulting firms and operators adopting at scale, which has been encouraging given our early evangelism of the holistic framework last year.

Driving better health access by aligning opportunities from wellness through primary/specialty care to life sciences is coming to light in a variety of exciting and innovative ways.

For example, we’ve seen the infusion of precision fitness & wellness coaching into care models to reduce fall rates in MA populations or to reverse Type 2 diabetes. We’ve also seen the integration of social care (e.g. peer-to-peer support) into care models to drive better outcomes and reduce spend within complex populations like Medicaid and SUD.

And most interestingly, we’ve seen an increase in PhD-led biotech companies leveraging deep science in an effort to revolutionize consumer health experiences. Examples include the real-time monitoring of multiple analytes (i.e., Levels 2.0) or the creation of novel alternative proteins, just to name a few. We’ve been leaning into this space a bit more in an effort to further diversify our whole-person health approach and to take advantage of our growing access to world-class scientists.

As we continue to build a synergistic network of companies, it’s important to not lose sight of the human elements of portfolio management. We feel extremely proud of the way we show up as board members and as stewards during times of crisis. The fall of SVB and the chaos that ensued tested our ability to serve as a guiding light, and we faced that adversity head on.

2023 represents an exciting time to capitalize innovative companies. Some of the most successful venture-backed companies of all time were built during times of austerity and we view the market rebalancing as an opportunity to build an enduring firm. We look forward to applying all of our learnings to help further bolster Fund I and to craft a promising future.

If you are building or investing within health & wellness, we’d love to chat! Please reach out to jordan@nextventures.com or head over to our website.

https://pitchbook.com/

https://woodsidecap.com/wp-content/uploads/2023/02/WCP-Newsletter-Health-Tech-Q4-2022_.pdf

https://woodsidecap.com/wp-content/uploads/2023/02/WCP-Newsletter-Health-Tech-Q4-2022_.pdf