Tech-enabled Primary Care

Examining how innovation within primary care models can drive patient adoption and unlock savings benefits downstream.

Every month we write a piece encompassing themes within our whole-person health investment thesis. If you would like to receive it directly in your inbox, subscribe now.

Despite the positive effects that primary care can have on improving outcomes and reducing costs, utilization in the US remains persistently low. According to a JAMA study, 25% of Americans did not have a primary care provider (PCP) as of 2015.1 However, the digitization of the healthcare industry is breathing new life into the space, enabling the emergence of tech-enabled primary care models for commercial, publicly insured and self-pay patients.

Primary Care Opportunity

It’s always surprising to see the low proportion of US primary care spending (5% of total healthcare spending) relative to other OECD nations (~14% of total healthcare spending), especially given estimates of its cost savings effect further downstream. For example, the American Academy of Family Physicians has argued that each $1 of primary care results in $13 of less downstream healthcare spending.2 With $260B in annual spend across commercial and government-sponsored plans, primary care in the US represents a large, but fragmented opportunity with sufficient room to grow.

While the hope of leveraging technology and consumer-friendly experiences to help reverse the negative utilization trend is encouraging, it’s important to stress that adoption and efficiency should not come at the expense of quality. Care models should prioritize longitudinal care over transactional care, especially given a primary care provider’s ability to take a more holistic view of their patients and as primary care models increasingly look to take on risk.

Delivery of Care

Tech-enabled primary care models are delivered either in a digital-first or digitally-enabled manner, each with their own pros and cons.

Digital-first models offer greater scalability and higher margins, but arguably lack the in-person component required to sufficiently care for high-risk patients and to enter into at-risk arrangements with payers. And given how nascent digital-first, value-based care (VBC) implementations are, the cost savings data required to improve this sentiment is still TBD.

Digitally-enabled models combine clinic and virtual-based care to provide comprehensive coverage for patients. While this model can capture a significant share of health care spend and serve high-risk populations, it comes at the expense of scalability and cost given the brick & mortar footprint. As such, expanding the scope of virtual services over time can help augment care margins.

Importance of Technology

For companies successfully operating either modality at scale, heavy investment into building a vertically-integrated technology platform is the common denominator. Leveraging distinctive technology and a digital platform across the continuum of care drives provider enablement, which is core to how tech-enabled primary care models differentiate from traditional provider organizations. This is best exemplified by more mature, publicly-traded names in the space, such as One Medical (ONEM), that built its tech stack from the ground up.

From the start, ONEM made the conscious decision to build its technology platform in-house, including a proprietary electronic health record (EHR) system, a range of patient and provider facing workflows relevant to primary care, and interoperability features that help navigate members across healthcare settings.

Having homegrown, vertically-integrated components across the patient journey allow ONEM to better engage patients and to improve population health management for ecosystem partners. Most importantly, the company’s technology platform has been designed to optimize provider enablement by reducing UX pain points around EHR systems and billing procedures and by increasing interoperability with secondary and tertiary providers. This, in turn, allows ONEM to cut a third of the support staff normally required in a primary care practice and to reinvest the savings into creating a superior patient experience for its members.3

Revenue Model

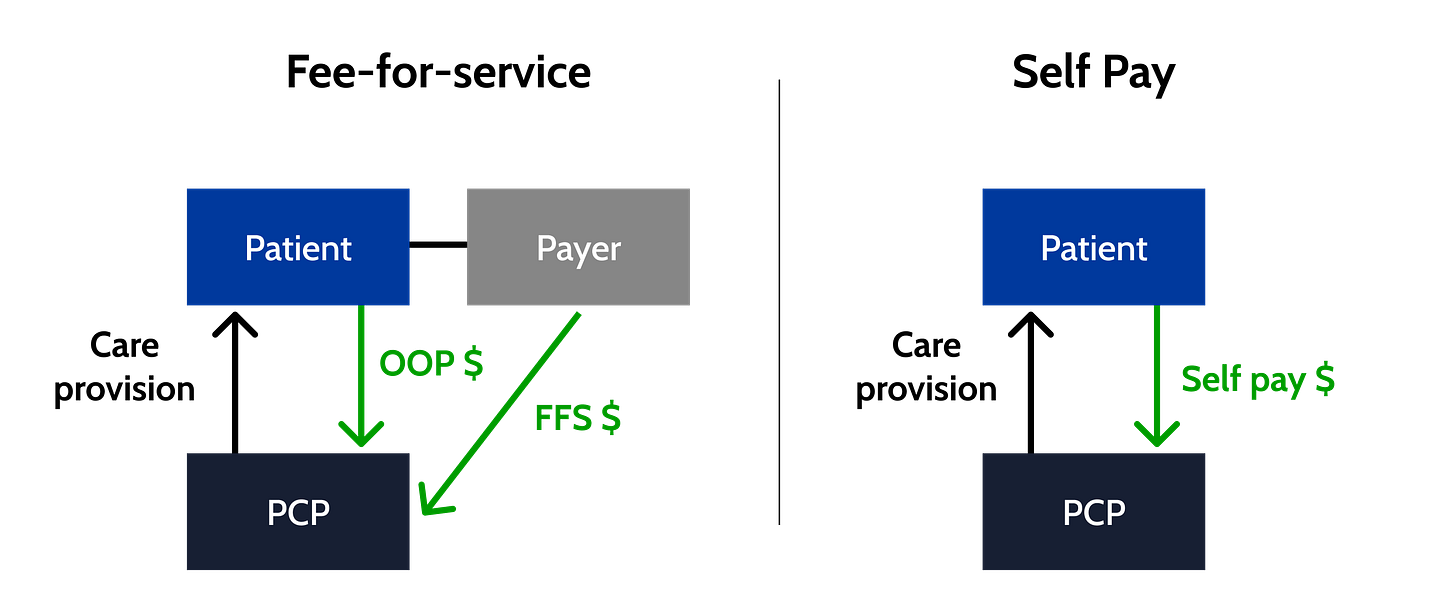

There are three core channels in which tech-enabled primary care businesses can generate revenue.

Membership: monthly membership fees paid by direct consumer enrollment or employer sponsorship. Depending on the model, membership can be required, optional or not utilized at all.

Net fee-for-service: per-visit fees paid by payers or self pay.

Health Network partnership: per-member-per-month (PMPM) fees paid by Health Systems looking to augment their existing primary care and network strategies or capitation paid by health plans/MCOs for managed care.

The utilization of these respective monetization channels varies based on a company’s go-to-market strategy, which can include targeting commercial and/or publicly insured patients across every stage of life.

Benefits

👨👩👧👦 Patients / Members

According to a 2020 report, 71% of consumers are dissatisfied with their healthcare experience, in part due to limited after-hours and digital access, long wait times for appointments, extended in-office delays, short and impersonal visits, uninviting medical offices in inconvenient locations, constrained access to specialists and a lack of care coordination across clinical settings.4

Given this sentiment, patients (or their employers) are often willing to pay a premium for care with vertically-integrated wraparound features that engage patients at every major touchpoint of the care continuum, whether that’s same-day/next-day scheduling, virtual chat, transparent patient portals, screenings, or follow-up recommendations, just to name a few.

Agency over care provision has also come to light with growing demand from patients who prefer to be treated by doctors that share the same race, ethnicity or gender, spawning new tech-enabled models that offer better patient-provider concordance.

👩🏽⚕️ Providers

The one aspect of tech-enabled primary care that remains ubiquitous across various offerings is the use of technology to lessen the administrative and operational burden for providers. As touched upon earlier when analyzing ONEM, a well-designed technology platform purpose-built for provider enablement can help to re-route tasks such as scheduling and billing to support teams and to make coordinating with secondary and tertiary providers as seamless as possible - ultimately helping mitigate physician burnout.

Building an end-to-end technology platform from the ground up, and in conjunction with significant provider input, gives PCPs everything they need to keep their medical practice workflows in one place.

☂️ Payers / Employers

The potential to reduce healthcare costs via tech-enabled primary care utilization remains the biggest benefit for health plans and employers. Modernizing the primary care patient experience to be more accessible and delightful can drive further adoption, making it easier to proactively identify and close care gaps across patient populations before they become high cost medical issues. For employers who subsidize membership, tech-enabled primary care can also serve as a lever to increase employee retention and combat absenteeism due to illness.

As it relates to cost reduction effectiveness, a recent JAMA Network Open study between Collective Health and One Medical found that the virtual + in-office primary care model linked to significantly lower employer total cost. The study observed the following spending reductions:

45% lower total medical and prescription claims costs ($167 PMPM)

54% lower spending on specialty care ($11 PMPM)

43% lower spending on surgery ($14 PMPM)

33% lower spending on emergency department care ($16 PMPM)

26% lower spending on prescriptions ($5 PMPM)

🏥 Health Networks

According to the American Hospital Association’s Futurescan survey of hospital CEOs and leaders published in 2019, 75% of hospital and health systems operate their primary care networks at a loss or are willing to do so.5 In essence, primary care practices within hospitals and health systems have historically functioned as a loss leader in order to generate downstream referrals to secondary providers across their network. As such, tech-enabled primary care practices with scale in particular regions offer a capital efficient primary care strategy for hospitals and health systems to leverage for incremental referral volume.

As it relates to at-risk arrangements, tech-enabled practices can partner with payers in which the former is responsible for managing the healthcare services and the associated costs of patients across its integrated network, facilitating more seamless access to partner specialists and facilities.

Expansion Opportunities

Primary care serves as an excellent nexus for care model expansion around specialty care, at-risk arrangements or comprehensive health care. This is a motion that’s been observed across precedent transactions such as Teladoc acquiring Livongo’s suite of chronic care solutions to complement its Primary360 service, or One Medical’s acquisition of Iora Health to expand its TAM to include capitated Medicare Advantage (MA) models. Organic expansion examples include Carbon Health’s newly rolled out diabetes management program or One Medical adding pediatric and behavioral health services in effort to provide more comprehensive health care.

Strategic activity to achieve multi-modal care is also a big theme as tech-enabled players look to improve their accessibility and provision of longitudinal care. For example, clinic-based Oak Street Health recently acquired RubiconMD to integrate and virtualize specialty care into its existing primary care model, ultimately aiming to streamline the referral process and lower costs.

As the tech-enabled primary care space matures, we should continue to see companies explore synergies and ways to drive longitudinal cross-sell (PMPM expansion) via care model breadth as well as strategies to capture lives adjacent to patients/members (e.g., dependents).

Final Thoughts

One of the core themes that undergirds our overall investment thesis is the concept of whole person health, which includes both formative and clinical layers of care. As it relates to the former, we’ve previously shared why we believe more investment into upstream care is needed in order to positively affect downstream utilization at the clinical layer.

While primary care sits within the clinical layer, it functions as a microcosm of the formative layer above it. Investing upfront in high-quality primary care has the ability to unlock utilization and savings benefits from significantly lower downstream specialty and acute care. We remain excited to watch founding teams in the space strive to serve as the key through innovative care models and across various care modalities.

If you are building or investing within health & wellness, we’d love to chat! Please reach out to jordan@nextventures.com or head over to our website.

https://jamanetwork.com/journals/jamainternalmedicine/fullarticle/2757495

KeyBanc Capital Markets, ONEM Initiation, ONEM: The Doctor Will See You Now (May 20, 2021)

KeyBanc Capital Markets, ONEM Initiation, ONEM: The Doctor Will See You Now (May 20, 2021)

https://investor.onemedical.com/static-files/5ad5aa5c-b18d-49d8-a683-d6fb984cc1fe

https://www.sec.gov/Archives/edgar/data/0001404123/000095012320006107/filename1.htm